Could a ‘Santa Rally’ provide a final boost for investors this year?

Despite stock market wobbles in recent days as concerns about the Omicron variant of COVID-19 have come to the fore, 2021 has thus far shaped up to be a year of strong returns for stock market investors. Since the start of the year, global equities have returned an impressive 21.4% (source: Lipper Investment Management: MSCI World Index Total Return GBP from 30/12/20 to 26/11/21).

With just a month to go until the year is over, most investors should be pleased just to hold on to such gains. However, some investors will be hoping that the year has even more to give yet, with the potential for December to offer up a financial Christmas present. That’s because of December’s reputation as a strong month for stock markets, a phenomenon dubbed the “Santa Rally”.

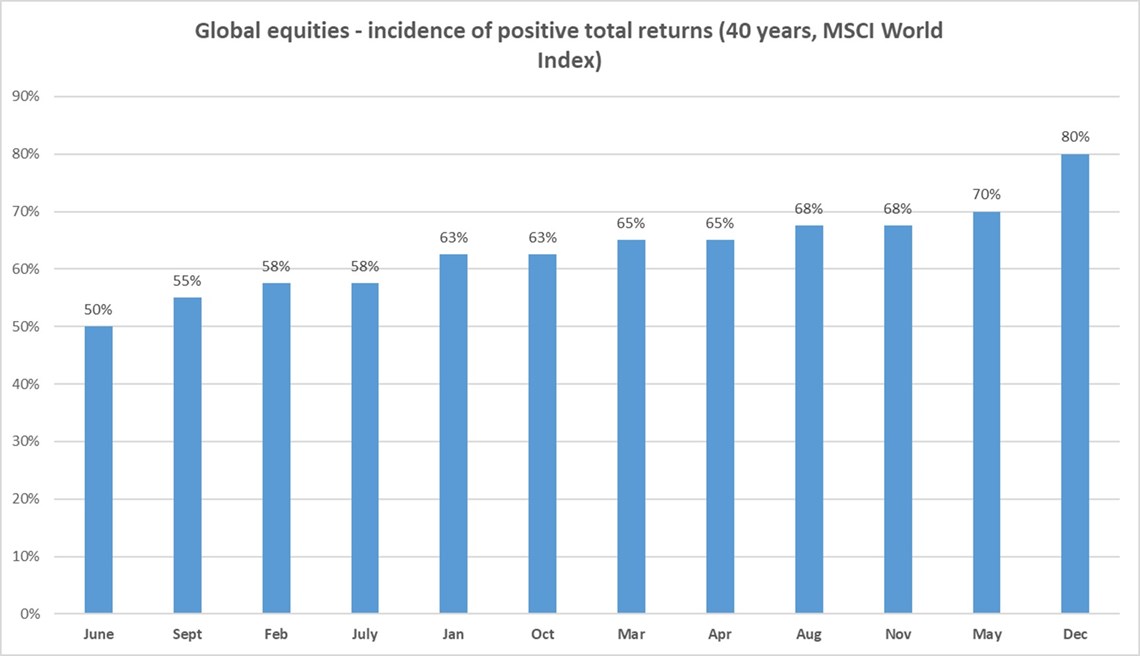

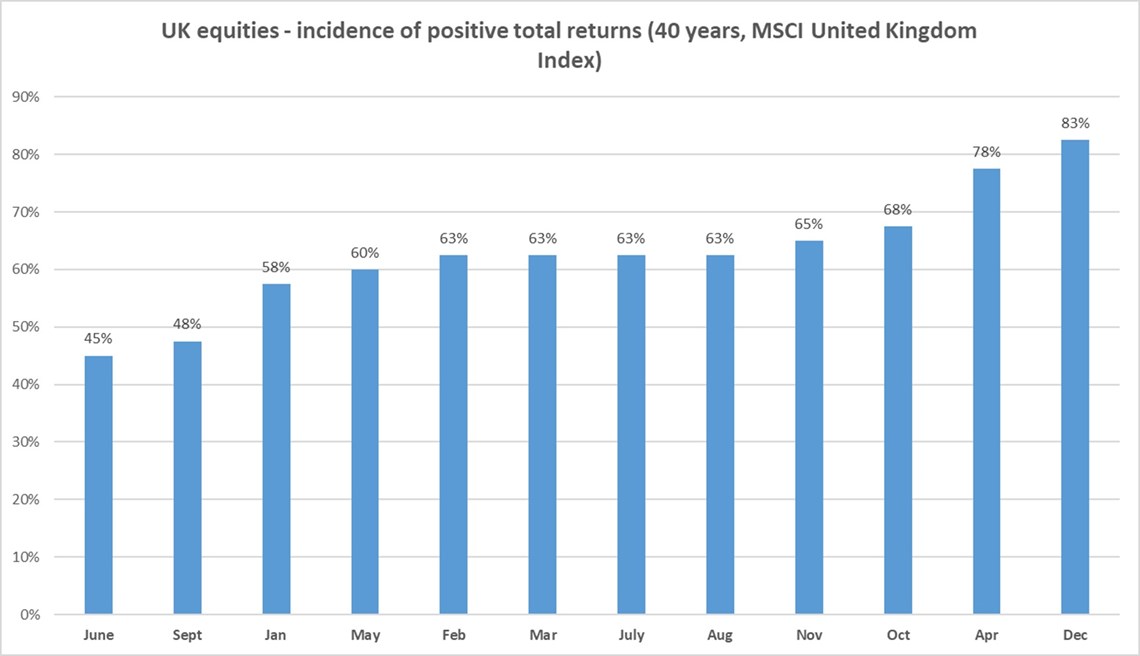

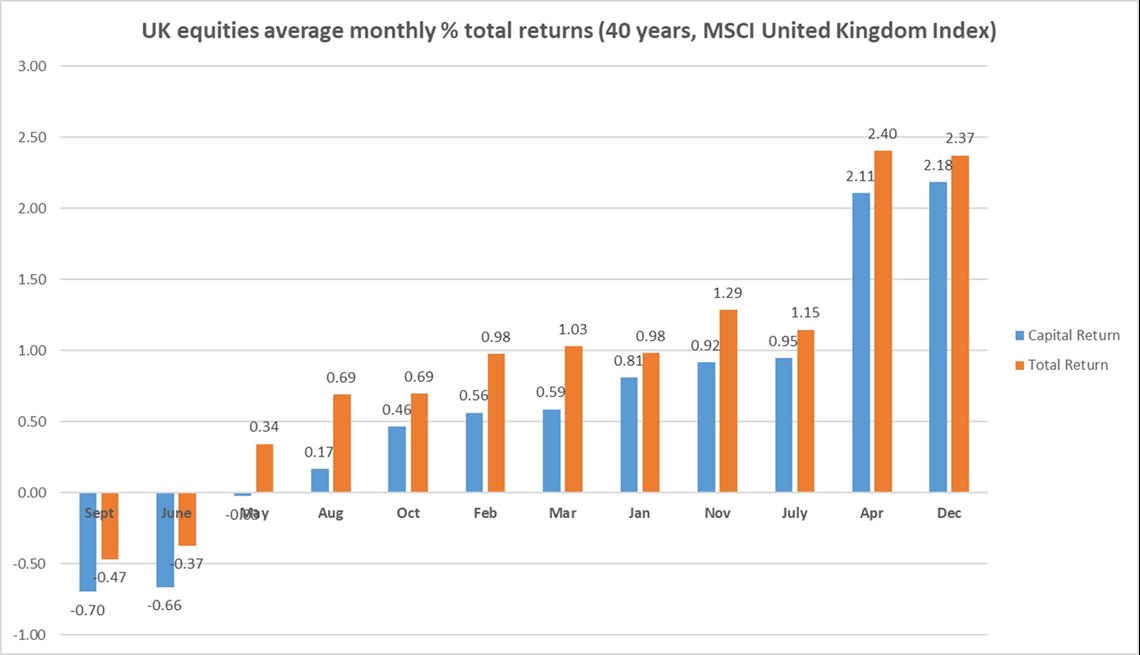

Bestinvest, the online investment service for private investors, has put this theory to the test, analysing forty years of data for monthly returns on global stock markets and also the UK (using the MSCI World Index and MSCI United Kingdom Index).

Jason Hollands, managing director of Bestinvest, commented:

“Far from being a myth, we found compelling evidence to support the idea of a ‘Santa Rally’. Looking at forty years of monthly market data, December has the highest incidence of any month in providing investors with positive returns both globally and in the UK. Global equities have delivered positive returns 80% of the time in the month of December over this period, far higher than any other month. And when it comes to the UK stock market, this success rate is even more pronounced, with December delivering positive returns 83% of the time.”

When it comes to the average returns generated by the month of December, Bestinvest’s analysis has also revealed an encouraging end of year pattern. Global equities have delivered an average capital return of 1.68% in the month of December over the last forty years, rising to 1.85% when reinvested dividends are also taken into account. This marks December out as having the highest average returns of any month, followed by November and January. December has also provided the highest average capital returns in the UK market: 2.18% rising to 2.37% once dividends are included. In contrast, Bestinvest’s analysis has identified September as the most dangerous month on average for stock markets, both globally and in the UK, with average returns that are negative.

Hollands added:

“There are various theories about seasonal trends in stock markets including the theory that investors should ‘sell in May’ and return after the summer, but it does seem that the ‘Santa Rally’ really is one of the most convincing. Explanations as to why stock markets tend to do well in December include the markets getting a boost as professional fund managers position for the year ahead, investing any spare cash in their funds to ‘window dress’ their portfolios ahead of reporting periods. Another is that hedge funds who take negative bets on companies – known as ‘short positions’ - close out some of these positions before the year end, which requires them to buy shares that they have previously sold. Of course, it could just be a case of seasonal cheer and the magic of the festive season!”

”It is important to be aware that while December is often a strong month for the markets, there is no guarantee this will be repeated this year with jitters about the new ‘Omicron’ variant of COVID-19 and inflation a continuing concern. It’s easy to be swayed by short-term market movements and news but the most important thing for investors is to focus on are their longer-term goals. Whether markets go up, down or move sideways in over the coming weeks, over longer-term time periods equities have consistently beaten cash returns.

“With meagre returns on cash savings and very low yields on bonds, it is unsurprising that equities are looked upon favourably in the current environment. In particular, the UK stock market is relatively cheap compared to other major markets at the moment, which is why there are so many bids taking place for UK companies by overseas investors who can spot a bargain.”

- ENDS -

Source: Bestinvest / Lipper Investment Management. Data from January 1982 – October 2021. MSCI World Index, Total Return in Sterling, dividends reinvested.

Source: Bestinvest / Lipper Investment Management. Data from January 1982 – October 2021. MSCI World Index, returns in Sterling.

Source: Bestinvest / Lipper Investment Management. Data from January 1982 – October 2021. MSCI United Index, Total Return in Sterling, dividends reinvested.

Source: Bestinvest / Lipper Investment Management. Data from January 1982 – October 2021. MSCI United Kingdom Index, returns in Sterling.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.