Tilney Model Portfolio on Platforms cuts costs by up to 26.7% year-on-year

The Tilney Model Portfolio on Platforms service, which offers financial advisers’ access to Tilney Smith & Williamson’s model fund portfolios via the wrap platform of their choice, has revealed that it has reduced costs by an average of 18.4% per annum over the last 12-months – and a reduction of up to 26.7% in the case of the Tilney Income & Growth strategy.

The Tilney Model Portfolio on Platforms service includes seven risk rated models and two additional income focused strategies. The service is available on a dozen platforms, providing financial advisers with a wide range of choice. Under lead portfolio manager Anton Snell, the team primarily invests through funds and ETFs.

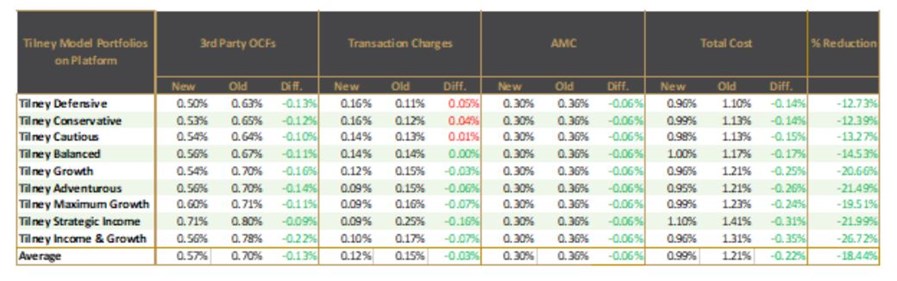

The team has been able to reduce costs clients in three ways. The biggest factor driving costs lower has been a reduction in the costs of the underlying funds selected through the introduction of smart beta funds to sections of the portfolios as well as using the firm’s scale to drive actively managed fund costs downwards, together shaving underlying fund costs down by -0.13% over the year. A second factor has been the removal of VAT on the 0.3% annual management charge for the service, cutting 0.06% from overall costs. The third factor has been an average reduction in transaction charges of 0.03% across the range. Together these have reduced average total costs from 1.21% to 0.99% over the year, equivalent to an average total cost reduction of 18.4% (excluding platform fees).

Craig Wright, Managing Director at Tilney Smith & Williamson commented: “We launched the Tilney Model Portfolio on Platforms service in 2011 to allow financial advisers to outsource their investment management to a trusted partner and be able to spend more time with their clients and grow their businesses.

“The Tilney Model Portfolios on Platforms range, which is focused on open-ended funds and ETFs, complements our Smith & Williamson MPS offering, which is distinctive in incorporating positions in investment companies. The Tilney Model Portfolios are available on a dozen retail platforms and are mapped to a wide variety of risk-mapping services such as Dynamic Planner, Synaptic, Oxford Risk, Defaqto and FinaMetrica.

“Over the last decade we’ve seen interest in our outsourced solutions grow as financial planning firms increasingly grapple with the complexities and costs of investment management. The reduction in the costs of our Model Portfolio on Platforms service is great news for financial advisers and their clients.”

MPS is popular with financial advisers looking for a low cost, accessible outsourced discretionary investment solution. The minimum investment required for the Tilney MPS range is £10,000. Since 1 January 2021, no VAT has been charged on any of the group’s MPS solutions. In addition to MPS, the group has the ability to provide the clients of financial advisers with bespoke discretionary investment, AIM portfolio services and a range of multi-asset OEIC funds (the Tilney Active Portfolios).

- ENDS -

Appendix – Breakdown of Cost reductions

Source: Tilney Investment Management Services Ltd

Disclaimer

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. The value of an investment may go down as well as up, and you may get back less than you originally invested.

Issued by the Tilney Smith & Williamson group of companies (the “Group”) which comprises Tilney Smith & Williamson Limited and any subsidiary of Tilney Smith & Williamson Limited from time to time. Further details about the Group are available at www.tsandw.com/compliance/registered-details.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.