Tilney Smith & Williamson announces record financial results and excellent progress with the integration in the first full year since completion of its merger

Tilney Smith & Williamson is pleased to announce its financial results for the year ended 31 December 2021, achieving strong momentum in new business and both record assets under management (AUM) and Adjusted EBITDA [1].

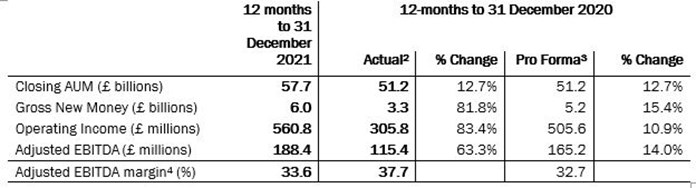

2021 Key Financial Measures

Financial Highlights

- Assets under Management (AUM) increased 12.7% to an all-time high of £57.7 billion.

- Record gross new business inflows of £6.0 billion, representing 11.7% of opening assets, with net new business inflows increasing to £2.5 billion (2020: £0.7 billion), representing 4.9% of opening assets.

- Group operating income increased 83.4% to £560.8 million.

- Adjusted EBITDA increased 63.3% to £188.4 million.

- Adjusted EBITDA as a percentage of operating income was a sector leading 33.6%.

- The Group further strengthened its robust balance sheet with total equity increasing to £1,391.3 million as at 31 December 2021 (2020: £1,339.3 million).

Strategic Highlights

- Integration of Tilney and Smith & Williamson substantially completed, with new operating models largely implemented, teams and investment process combined, good progress made in consolidating office locations and run rate cost synergies achieved ahead of target.

- On the back of the integration, and having undertaken detailed research among clients and staff, the Tilney and Smith & Williamson brands will be consolidated under a new name in the summer: Evelyn Partners. The choice of a new name reflects the fact that the business is now one firm with a single purpose enabling it to offer a broader, integrated offering to all clients. The new name is rooted in the company’s heritage [5] but is also both timeless and contemporary. More information on the rebrand can be found here: www.evelyn.com

- Strong progress with our digital transformation agenda. We have created a new integrated Financial Services platform, tailored to our needs which combines state-of-the-art reporting, execution and settlement solutions with in-house custody. The business successfully migrated the first tranche of clients to the new platform during the course of the year. The Group has also started to implement a new platform for the Professional Services business which will similarly further enhance client experience and improve operational efficiency.

- Post period end the business announced plans for the relaunch of Bestinvest [6] as a hybrid digital service combining best-in-class goal planning and analytical tools with free access to investment coaching from qualified professionals, alongside its execution-only offering. A new suite of highly competitive low-cost ready-made portfolios have also been launched, together with a simplified pricing structure.

- The business continues to explore opportunities to enhance growth through acquisitions and in March 2021 completed the acquisition of wealth management business HFS Milbourne, which added £376 million of assets to the Group in the second quarter of 2021.

- In September 2021 the business launched a succession programme to give financial advisers approaching retirement an opportunity to find a new home for their clients. Two high quality businesses have already joined under the scheme and there is a strong pipeline for 2022.

- Launched our new bold statement of purpose in September: to place the power of good advice into more hands, alongside setting out the core values for the combined Group.

Chris Woodhouse, Group Chief Executive, commented:

“2021 was a landmark year for the Group, in which we successfully combined Tilney and Smith & Williamson, while at the same time achieving our best year ever for both organic growth and underlying profitability.

“Our increased scale, combined with strong new business generation across both our Financial Services and Professional Services businesses, has meant that it has also been a significant year in terms of financial performance. We delivered record gross new business inflows of £6 billion – 11.7% of opening assets - and Group operating income of £560.8 million, helping to generate £188.4 million of Adjusted EBITDA, a 14.0% increase over 2020 on a pro forma basis. Our Adjusted EBITDA margin of 33.6% - a key measure of business profitability and efficiency – has increased year-on-year on a like-for-like basis and remains industry leading when compared to peers.

“Delivering excellent client experience is core to our success and during the course of the year we continued to make strategic investments into areas which will enhance and enrich client outcomes. In addition to our focus on hiring new talent, we also made significant progress with our digital transformation agenda. This has included the creation of a leading-edge and scalable financial services platform on to which we have begun successfully migrating clients. We aim to roll-out our App and digital portal to more of our clients during 2022.

“The relaunch of our Bestinvest platform in Q2 2022 will bring a host of new features, combining innovative digital tools with free access to investment coaches who are qualified financial planners. The relaunched Bestinvest will be especially well-positioned to help the many millions of people who are not currently getting the support they need to make their money work harder and achieve their goals. This is us making good on our statement of purpose to place the power of good advice into more hands.

“Notwithstanding current market volatility and the dreadful events unfolding in Ukraine, we have very strong foundations in place for future growth. We have both operational and financial strength and a large and growing pool of talent. We now have an unrivalled service proposition that spans DIY investing, financial planning, investment management and tax advice to help clients manage their personal wealth, alongside an extensive range of professional services for businesses. We are therefore uniquely well positioned to support clients with both their personal wealth management needs and business interests. As we become Evelyn Partners this summer, we look forward to a new and exciting chapter, focused on the future as truly one firm.”

ENDS

Notes

1. Adjusted Earnings Before Interest, Tax, Depreciation and Amortisation. This is the Group’s key measure for underlying financial performance which adjusts for non-cash accounting charges and non-recurring exceptional costs such as those incurred on completing a major transaction.

2. The acquisition of Smith & Williamson by Tilney completed on 1 September 2020 and so Group results for 2020 reflect 12-months of the Tilney business and a 4-month contribution from Smith & Williamson.

3. Pro forma comparisons for 2020 are provided to illustrate the full-year effect had Smith & Williamson been part of the Group since the start of 2020. They have been compiled by aggregating the audited 2020 financial statements of Tilney Smith & Williamson Limited with the financial data extracted from the books of Smith & Williamson over the 8-month period from 1 January 2020 to 31 August 2020.

4. Adjusted EBITDA as a percentage of operating income.

5. The name Evelyn Partners is inspired by a pivotal moment in our history: the start of our UK-wide expansion from our regional origins in 1883 by one of our founders, Andrew Williamson, from Evelyn Gardens, London. The move heralded a period of growth and transformation, much like the one we are experiencing today on the back of our merger.

6. Following the Group rebrand in the summer, Bestinvest will be retained as a separate brand: Bestinvest by Evelyn Partners.

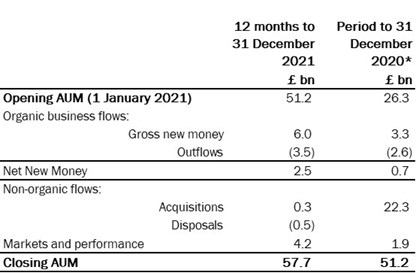

Assets under management

* Period to 31 December 2020 comprises a full-year of Tilney and 4-months of Smith & Williamson as part of the Group following completion of the transaction on 1 September 2020.

Acquisitions and disposals include the sale of a non-core fund range and the acquisition of HFS Milbourne in H1 2021 and the addition of Smith & Williamson to the Group in September 2020.

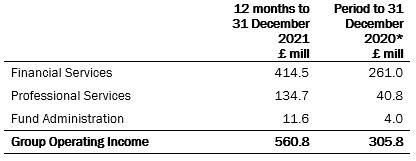

Operating income – segmental breakdown

* Period to 31 December 2020 comprises a full-year of Tilney and 4-months of Smith & Williamson as part of the Group following completion of the transaction on 1 September 2020. In our 2020 accounts, operating Income from Fund Administration was reported under Financial Services but has now been created as a separate segment.

Images

Example of new imagery for Evelyn Partners

Chris Woodhouse, Chief Executive, Tilney Smith & Williamson

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.